Blogs

They always should be completed inside the basic ninety days away from starting the newest card. We review an informed credit card acceptance added bonus also provides centered on the brand new buck valuation the bonus brings. Of course, never assume all loyalty software supply the same well worth suggestion, so we dictate the value of a recently available extra render based to your our very own month-to-month issues and you will miles valuations. For example, if the a pleasant added bonus give are 60,one hundred thousand things so we really worth those points at the 2 cents for each, the benefit may be worth $1,two hundred. DansDeals can get compensation when you are accepted to have a credit credit via an association in this article. Terms connect with Western Display benefits while offering, go to americanexpress.com to find out more.

SoFi doesn’t costs a feefor inbound cord transmits, nevertheless delivering bank may charge a fee. Comprehend the SoFi Examining & mrbetlogin.com helpful resources Savings Fee Sheet for info atsofi.com/legal/banking-fees/. Up until relatively recently, SoFi wasn’t technically a bank—even though consumer dumps have been FDIC insured4. SoFi turned an online financial inside 2022 and certainly will now render conventional financial issues.

Simultaneously, it offers flexible part redemption alternatives, no international transaction charges, and expert travel insurance coverage along with number one vehicle local rental insurance rates. That have professionals like these, it’s easy to understand as to why which credit is a wonderful choices for the tourist. The newest Chase Sapphire Preferred cards is one of the better travel rewards cards to the market.

How to locate a knowledgeable mastercard invited bonus to you personally

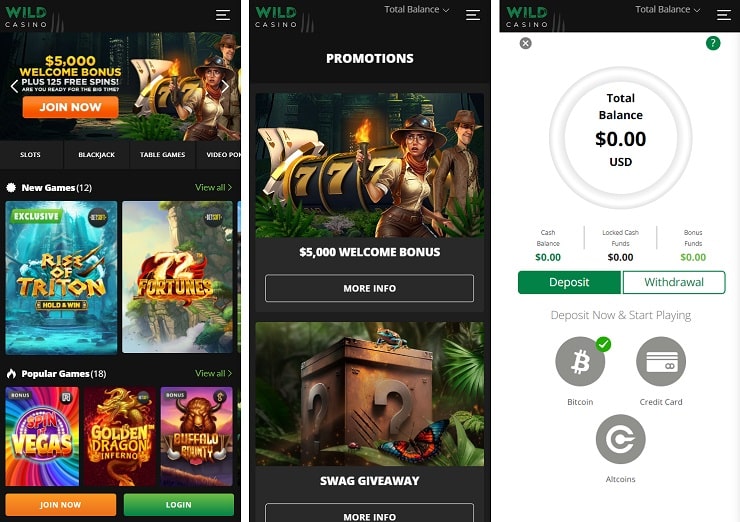

During the NoDeposit.org, we pride our selves on the offering the really right up-to-go out and reputable zero-deposit extra rules to own professionals looking to take pleasure in risk-free playing. Our team constantly reputation so it checklist to make sure you do not miss from the new now offers, when it’s 100 percent free revolves otherwise added bonus cash. With the curated options, you can trust me to hook you to an informed zero-put bonuses available today.

Incentives And Campaigns

You can earn an excellent Secure a great $three hundred added bonus when you unlock an excellent Pursue Full Savings account and you will set up head dumps totaling $500 or higher within this 90 days. You’ll get the incentive inside 15 times of getting a good qualifying direct deposit. You can discover a free account online which have a discount code, or by going to a great Pursue part and you will using the promotional code to you. The modern Citi bank account incentives require that you haven’t had a great Citi bank account in the last 365 days. When you have a current Citi checking account, for example, however, don’t currently have a bank account for the lender, you are eligible to be eligible for a good Citi family savings extra. In the CNBC Find, all of our objective is to render our very own clients with high-top quality provider news media and you may full consumer advice so they can generate informed decisions with their currency.

Sign-right up bonuses (also called welcome offers or basic bonuses) try a favorite rewards card feature. A knowledgeable indication-upwards incentives offer nice advantages to possess a good level of paying and can make it easier to maximize professionals in the beginning. If you’lso are searching for travelling perks, declaration credits, otherwise money back, now is a great time when planning on taking benefit of signal-right up incentives as the card providers offer their finest acceptance also offers. For every bank card issuer features its own laws and regulations for how often a customer is secure a pleasant incentive. This is to save consumers away from “churning” extra also offers or, put differently, away from signing up multiple times to have a credit strictly to earn the advantage, without goal of actually utilizing it long-identity.

Account added bonus offers

- Simultaneously, you should buy much more 100 percent free bonuses away from respected gambling establishment names having 100 percent free processor chip rules.

- When you’re Amex hasn’t established exactly what welcome incentive will be available if this render is over, it’ll most likely return to the earlier provide one to’s well worth $250 money back.

- Instead of other financial offers, that are one-day also provides, Nations Financial makes you earn which added bonus year in year out.

- That it render finishes Get 12, and when you have been on the fence on the a different traveling bank card, it opportunity should not be skipped.

- Bank bonuses is a highly attractive unit to have a bank in order to expand the sticky put base.

I’ll browse the render details plus the fine print to help you modify this information. We consider them to getting a good lender having an effective and stable operation. Online slots games are a good choice while they usually contribute one hundred% to your betting conditions. Games including electronic poker, baccarat, web based poker, and black-jack lead up to 10%.

Very bank card indication-right up bonuses can handle people with a great or excellent credit. Notes having more enjoyable borrowing from the bank criteria may offer the occasional sign-up extra, however the incentives could be smaller than individuals with notes to own an excellent otherwise expert borrowing from the bank. Because if this is not adequate, you can earn a supplementary $dos,100000 dollars bonus for each and every $five-hundred,one hundred thousand invested within the first year! And this credit keeps rewarding your having an annual fee refund each year you may spend $150,one hundred thousand. Whether you’re also a new comer to traveling perks or if you only want to add a smooth benefits cards to the blend, the brand new U.S. Referring having the lowest yearly commission and you will competitive bonus advantages on the fuel, take a trip, eating, and you will food good for newbies.

Chase Safe Financial Bonus: $one hundred for new Users

She never ever applied throughout that several months and you will hasn’t tried since it are at some point closed, and so i can be’t say for certain, but We’m guessing the answer to your enquiry is sixty+ weeks. One good way to end overspending would be to day beginning the new card which have an upcoming expenses. Generally, you might redeem items for cash right back or report credits in the an elementary step 1 suggest step one cent ratio. Present credit, shell out which have things and you can take a trip or gift ideas portal redemptions could have additional beliefs with regards to the information on your redemption. The information about non-associate now offers to your Bluish Dollars Well-known Cards away from American Display are collected independently from the cardsandpoints.com.

In any event, make sure you know very well what constitutes an eligible pick. Generally, people simple purchase of merchandise otherwise services have a tendency to number. Delta SkyMiles Set aside American Express Players get 15% from when using miles to book Prize Take a trip to the Delta routes due to delta.com and the Travel Delta software. Disregard maybe not applicable to help you mate-manage routes or perhaps to fees and fees. Get expert advice, actionable procedures, and exclusive now offers that can help it can save you many spend which have confidence.

Prefer TD Beyond Examining and secure $three hundred that have being qualified direct dumps, along with you can earn interest. You can even earn the main benefit from the spending the very least month-to-month matter otherwise making you to definitely highest pick that fits the requirement. As an example, if you’d like to earn a $two hundred greeting added bonus, the new bank might require one purchase $step 1,one hundred thousand in this 90 days. You additionally shouldn’t apply for a credit card in order to earn the new acceptance extra. You ought to look into the card’s other features and you will costs to help you make certain it suits as well to your normal spending patterns.